Salesforce Revenue Cloud: A Complete Guide to Boost Revenue and Efficiency

At the end of 2020, Salesforce introduced Salesforce Revenue Cloud as part of its Customer 360 Platform. This powerful solution integrates CPQ (Configure, Price, and Quote), Billing, Partner Relationship Management, and B2B Commerce, all aimed at helping organizations streamline their revenue processes and enhance growth across multiple sales channels.

What is Salesforce Revenue Cloud?

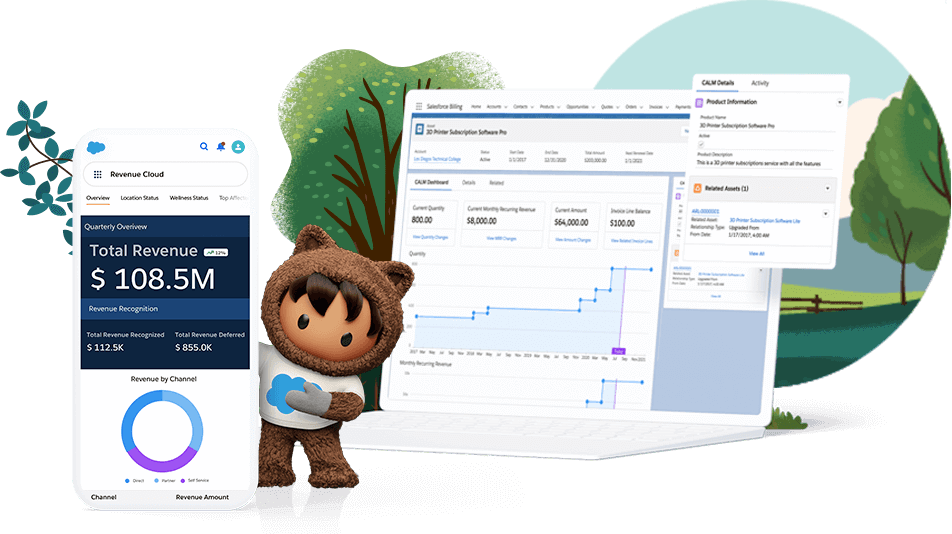

Image Source = Google | Image By – Salesforce

Salesforce Revenue Cloud is designed to simplify revenue management by consolidating different tools and workflows into one powerful platform. With features like Salesforce CPQ & Billing, companies can optimize their sales models, which include subscription, recurring revenue, and consumption-based models. This helps businesses improve forecasting, automate manual tasks, and increase efficiency.

Key Features of Salesforce Revenue Cloud

Sales Models: Supports various sales models, including:

- Direct sales

- Sales through partners

- Self-service commerce

- Sales in specific industries like telecommunications, insurance, and energy.

- Product Bundling: Streamlines the process of bundling complex product arrangements.

- Invoicing and Payments: Automates invoice generation and offers multiple payment methods.

- Dunning and Collections: Simplifies the management of late payments and collections.

- Risk Reduction: Decreases financial risk by automating complex billing and sales processes.

How Does Salesforce Revenue Cloud Work?

Salesforce Revenue Cloud provides a backend that enables users to access detailed sales data by channel, such as direct sales, partner sales, or self-service sales. Users can also view revenue breakdowns by product, track historical earnings, and analyze sales trends over specific periods (e.g., quarterly reports). Additionally, the platform keeps product catalogs and pricing updated automatically, enabling smooth payment processes.

Businesses use Salesforce Revenue Cloud to:

- Analyze sales data and trends to make strategic adjustments.

- Automate payment processing and customer management.

- Monitor revenue sources across sales channels.

Benefits of Salesforce Revenue Cloud

The Salesforce Revenue Cloud offers numerous benefits to companies seeking to scale their revenue and streamline sales processes:

- Expand Revenue Streams: With features like subscription packages and alternative pricing models, organizations can explore new revenue opportunities. This is particularly useful in industries such as manufacturing or financial services.

- Improve Revenue Tracking: Sales teams gain access to detailed real-time analytics, enabling better decision-making. Businesses can identify new ways to monetize products while automating time-consuming processes.

- Increase Efficiency: The platform’s automation capabilities significantly reduce the need for manual data entry, order transcription, and approval processes. This not only minimizes errors like underbilling but also enhances overall revenue efficiency.

- Enhance the Purchasing Experience: By utilizing the Consumer Asset Lifecycle Management platform, Salesforce Revenue Cloud ensures seamless transitions between sales channels such as direct, partner, or self-service commerce, improving the overall customer experience.

Why Invest in Salesforce Revenue Cloud?

Investing in Salesforce Revenue Cloud provides businesses with a flexible, scalable solution for revenue management. Key reasons to invest include:

- Flexibility in Pricing: Create and manage new pricing models, including subscription and consumption-based plans.

- Streamlined Revenue Management: Track revenue effortlessly across sales channels with integrated tools like CPQ and Billing.

- Automated Processes: Reduce administrative tasks through automation, allowing teams to focus on higher-value activities.

- Seamless Multi-Channel Sales: Consolidate sales from direct, partner, and self-service channels into one system, improving both customer and employee experience.

With Salesforce Revenue Cloud, businesses can simplify revenue management, enhance efficiency, and explore new growth opportunities.

Leave A Comment